American Frame Data Breach Lawsuit | Stolen Credit Card Information

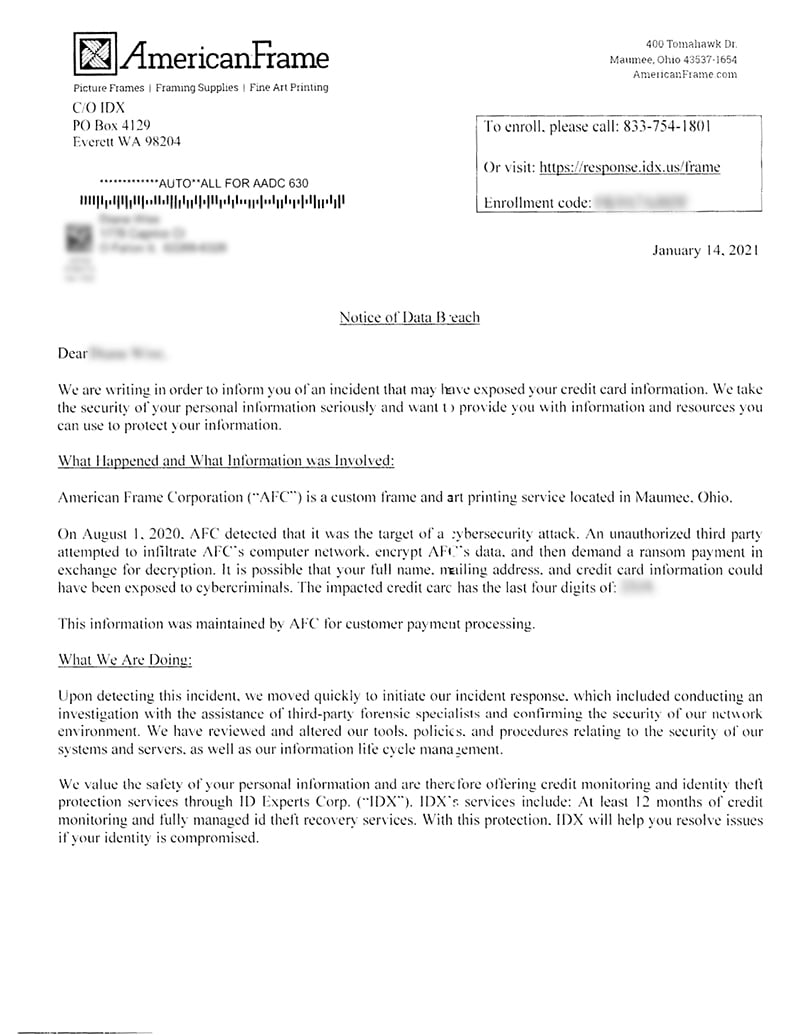

In January 2021, American Frame sent a letter to its customers warning them of a data breach that occurred in August 2020:

On August 1, 2020, AFC [American Frame Corporation] detected that it was the target of a cybersecurity attack. An unauthorized third party attempted to infiltrate AFC’s computer network , encrypt AFC’s data , and then demand a ransom payment in exchange for decryption.

According to the letter, exposed information from customers include:

- Full Name

- Mailing Address

- Credit Card Information

Data breaches occur when unauthorized parties gain access to private information. It can be the result of a cyberattack that exposes a corporation’s database or a merchant’s payment system. When a data breach happens, financial information and credit card information from customers can be compromised. This can lead to a number of problems, including fraudulent credit card transactions and identity theft.

Peiffer Wolf Carr Kane & Conway represents consumers in lawsuits against corporations around the world that fail to adequately safeguard customer information. If you’ve been notified of the American Frame data breach or have shopped there prior to August 2020, please contact Peiffer Wolf by filling out an online contact form or by calling 314-833-4827 for a FREE Consultation.

What is a Data Breach?

A data breach means that private/confidential information is accessed and/or exposed by unauthorized people or organizations. The information acquired from data breaches can include name, login information, passwords, e-mail and physical addresses, credit card numbers, etc. In some instances, it can even include Social Security numbers.

Companies and institutions storing data for consumers have a legal obligation to keep it secure and inaccessible to third parties. They can be held liable for failing to keep your information safe. If American Frame failed to adequately safeguard your financial information, please contact Peiffer Wolf by filling out an online contact form or by calling 314-833-4827 for a FREE Consultation.

Data Breach: Why American Frame?

Although the headlines typically focus on ransomware, credit card thieves continue to attack merchants like American Frame. Cybercriminals continue to attack companies, retailers, and merchants that have not installed credit card readers that require chip-based payment cards. Additionally, many companies do not have adequate safeguards and security measures in place to protect from data breaches.

NYU researchers found that one cyber criminal, BriansClub, “earned close to $104 million in gross revenue from 2015 to early 2019, and listed over 19 million unique card numbers for sale.”

American Frame Data Breach | What Should You Do?

If American Frame sent you a notice that a data breach occurred and your information was compromised, you should take a few steps to protect yourself.

- If credit/debit card information was stolen, you should cancel your credit/debit card and ask for a new one;

- Change your passwords and security questions for the breached accounts. If you use the same or similar passwords for other accounts, change them as well;

- If your Social Security number was stolen, you might consider a credit freeze and should have a credit monitoring service set up;

Protecting yourself after a data breach comes at a high price, and you will have to spend time and money to make sure you are not the victim of fraud and identity theft. That is why it is imperative that you take action and demand compensation.

Peiffer Wolf Carr Kane & Conway represents consumers in lawsuits against corporations and merchants around the world that fail to adequately safeguard customer information. Please contact Peiffer Wolf by filling out an online contact form or by calling 314-833-4827 for a FREE Consultation.

Free Consultation | Data Breach Lawsuits | 314-833-4827

Peiffer Wolf Carr Kane & Conway represents consumers in lawsuits against corporations and merchants around the world that fail to adequately safeguard customer information. If your information has been compromised, please contact Peiffer Wolf by filling out an online contact form or by calling 314-833-4827 for a FREE Consultation.

DATA BREACH LAWSUITS IN THE NEWS

Yes. Please call us or use our contact form to request a Free Case Evaluation. We have a national team of attorneys and staff who look forward to speaking with you.

Typically, we represent clients on contingency fee agreements. If we take your case under a contingency fee arrangement, you won’t owe our firm any legal fees unless we are able to recover money for you.

Our contingency fee agreements are usually based on a percentage of the amount we recover for our clients. The contingency fee amount is determined by the type of case, our estimate of how long it will take to resolve your case, and our estimate of the litigation costs we will advance in your case. Each engagement agreement includes the details of the fee arrangement. Questions about our fee agreements are welcomed and encouraged.

In most litigation matters, it is extremely difficult – practically impossible – to predict how long it will take to resolve a particular case. Every case is different, and we will do our best to provide you with an estimate based on your case and our experience with similar cases. Moreover, we will do our best to keep you updated and manage expectations along the way.

We handle cases that change lives. Contact us today for a FREE consultation.