Coronavirus | CNBC | Greg Iacurci | March 23, 2020

“Coronavirus scams are emerging, and many look remarkably similar to frauds from the 2008 financial crisis.

Government agencies like the Federal Trade Commission and Federal Deposit Insurance Corp. issued warnings this week for Americans to be vigilant as con artists attempt to steal from consumers spooked by an onslaught of bad news related to COVID-19.

‘In any crisis, you see scams pop up that are tied to the headlines,’ said Barbara Roper, director of investor protection at the Consumer Federation of America.

In many ways, the current crisis and its 2008 predecessor are quite different — this one caused by a pandemic that has infected more than 250,000 worldwide and the other by broad and systemic failures in the financial system.

During the Great Recession, investment fraud and other consumer scams were rampant, preying on people’s fear of uncertainty in the stock market and a high rate of unemployment rate, said Joseph Peiffer, managing partner of law firm Peiffer Wolf Carr & Kane.

Still, Peiffer expects a similar degree of foul play now, leveraging those same financial fears, during the coronavirus health crisis, which looks likely to plunge the U.S. into a deep recession in the near term.

Take economic stimulus, for instance.

Republican senators on Thursday unveiled a stimulus package that, among other things, would send up to $1,200 in relief payments to Americans. […]

Scammers have launched “phishing” attacks, via text message and e-mail, to take advantage of potential check recipients. Their messages can appear legitimate — perhaps with a prompt such as “Click here to get your money now.”

However, the hyperlinks are malicious. If the links are clicked, con artists can access a computer or phone and steal sensitive information such as Social Security numbers and bank account data. They can then steal identities, money or both.

Robo-callers posing as federal employees may also request sensitive information over the phone as a precondition to receive federal money.

These types of attacks are always underway, but ramp up during times of chaos.

David Jemmett, CEO of Cerberus Sentinel, a cybersecurity company, said he typically gets two phishing messages a month, but has gotten six over the last 48 hours tied to the idea of government checks.

[…]

Around one-third of executives on the CNBC Technology Executive Council said cyberthreats have increased as a majority of their employees work from home due to the coronavirus, according to a CNBC survey conducted this week.

Work-at-home and sweepstakes scams — which tout a fast way to make money — also proliferated during the financial crisis, when unemployment peaked around 10%, and will likely re-emerge in the coming weeks and months, Breyault said.

“These prey on people who, if they weren’t in desperate financial straits, might be more resistant to those types of scams,” he said.

Investment scams

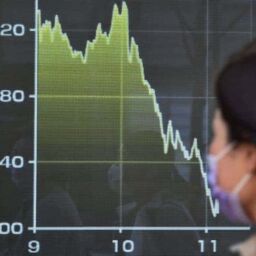

Similarly, investment scams taking advantage of extreme volatility in the stock market were a hallmark of the financial crisis.

The Great Recession saw investors flock to fake certificates of deposit, private placements, non-publicly traded real estate deals, promissory notes and scams involving gold and other precious metals, experts said. Many turned out to be Ponzi schemes and other frauds.

Scammers convince investors — who may have just witnessed their wealth evaporate in the stock market — that their investment scheme is both safer and more profitable than the stock market.

‘You get scared by the volatility,’ Roper said.

The coronavirus scare will undoubtedly lead to similar behavior. The Alabama Securities Commission issued a warning to investors on Friday to steer clear of brokers peddling investments related to vaccines or cures for COVID-19.

The stock market’s dramatic plunge in recent weeks is also likely to expose long-running frauds, as it did in 2008 with people like notorious Ponzi schemer Bernie Madoff, Peiffer said.

‘Criminals feed on fear,’ Jemmett said. ‘It’s the unknown.

‘Criminals try to take advantage of you while you’re in the dark.’”

FREE Consultation | 585-310-5140

Peiffer Wolf has helped thousands of investors who have suffered substantial losses. Contact Us by calling 585-310-5140 or by filling out an online Contact Form for a FREE Consultation.