Financial Crisis | USA TODAY | Jessica Menton | March 11, 2020

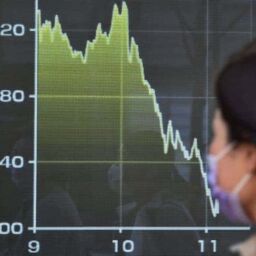

Dow Jones industrial average dropped more than 20% from its record high last month and putting it in bear territory for the first time since the financial crisis of 2007-2009

“The stock market’s 11-year bull run is pretty much over.

The Dow Jones industrial average dropped 1,464.94 points on Wednesday to close at 23,553.22, dropping more than 20% from its record high last month and putting it in bear territory for the first time since the financial crisis of 2007-2009.

The blue-chip average entered the new, gloomy market phase after the World Health Organization deemed the coronavirus outbreak a global pandemic and investors anxiously awaited fiscal stimulus plans from the government — which they hope will ease the damage to the economy.

[…] the Standard & Poor’s 500, the main gauge of U.S. stock markets, avoided entering a bear market by a hair. Wednesday’s rout left the S&P 500 down 19.2% from its Feb. 19 high. Wall Street professionals consider a bear market official when the broader index drops 20% from its peak.

The market’s swift decline and wild swings the past few weeks have rattled investors. It was only three weeks ago that the S&P 500 set the all-time high.”

Traders had been cautioning for months that stock valuations were stretched and poised to pull back

“Traders had been cautioning for months that stock valuations were stretched and poised to pull back after last year’s strong gains, with the S&P 500 surging nearly 29%. Safe-haven bonds have also fueled warnings about the global economy for months.”

“The WHO declared the virus a global pandemic Wednesday as the number of confirmed cases exceeded 121,000. Countries are shifting into damage-control as infections spread, prompting sweeping controls on travel, closures of schools and cancellations or postponements of sports events and many other public activities.”

[…]

“The New York Federal Reserve said Wednesday it will boost the amount of money it provides to banks for overnight borrowing to at least $175 billion through mid-April.”

“The Bank of England, meanwhile, cut its key interest rate by half a percentage point to 0.25% as an emergency measure in response to the outbreak of the deadly virus. The central bank said the move would “help support businesses and consumer confidence at a difficult time.”

FREE Consultation | 585-310-5140

Peiffer Wolf has helped thousands of investors who have suffered substantial losses. Contact Us by calling 585-310-5140 or by filling out an online Contact Form for a FREE Consultation.