Published by CNBC

Published 9:59 AM ET Thu, 21 Feb 2019

—

Each year, an estimated 50 percent of people are victims of financial foul play, and 16.5 percent say it’s in the form of investment fraud.

Not all cases that come before regulators involve large amounts, and sanctioned brokers can reappear at other brokerages even if their current employer fires them.

Any time you hear about a big fraud case involving many ripped-off investors, it’s a good reminder to think about your own situation.

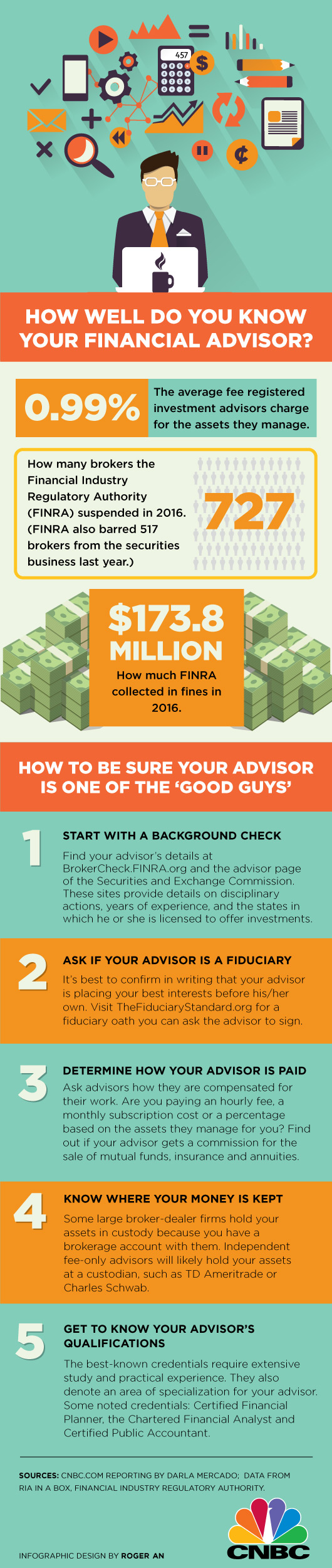

In other words, how well do you know your advisor or broker?

In December alone, brokerage firms agreed (without admitting or denying guilt) to an aggregate $2.4 million in fines — and more than half of that amount arose from inadequate supervision of brokers who caused investor harm, according to the latest rundown of enforcement actions by the Financial Industry Regulatory Authority.

Commonly called FINRA, it’s the self-regulatory organization for roughly 630,000 brokers — some of whom also are registered with the Securities and Exchange Commission as investment advisors — and the firms that employ them.

Each year, an estimated 50 percent of people are victims of financial fraud, according to a study from the Stanford Center on Longevity and the FINRA Investor Education Foundation. While that includes all sorts of scams and schemes, 16.5 percent of people surveyed for the research reported being a victim of investment fraud.

Just recently, the SEC ordered Woodbridge Group of Companies, a real estate investment firm, and its former owner to pay $1 billion in penalties and repayments for ill-gotten gains related to an alleged scheme involving 8,400 retail investors.

Yet individual instances of alleged wrongdoing don’t always involve huge dollar amounts, and many of the accusations, investigations and settled cases garner little attention.

In addition to financial firms getting sanctioned for lack of effective oversight, brokers themselves also can be fined, suspended from working with brokerages for a certain period of time, or banned entirely.

In one case included in the latest monthly FINRA roundup, a broker was barred from the industry for a variety of alleged misdeeds, including using client funds for his own purposes and attempting to hide it.

According to FINRA’s findings, Kyle Patrick Harrington of San Diego converted about $20,000 in funds from one customer and engaged in undisclosed private securities transactions with several other people, along with making false statements and providing false documents to his employer and to FINRA.

Specifically, FINRA’s findings state that in mid-2012, Harrington moved $19,874 of a customer’s funds into an account he owned and had his assistant falsify documents to facilitate the transfer.

When regulators began questioning him in 2016 about the event, he asked the client to sign a letter stating she had paid him to stay at his vacation home in 2012, FINRA documents show. (She did not agree.) And although he first told told FINRA the money was because the client rented his vacation house, he later said it was for investment management fees.

The client told FINRA that she thought the money was transferred to her individual retirement account.

In November 2016, an internal review at Harrington’s then-employer, National Securities Corp., revealed the questionable transfer and he was fired, FINRA documents show.

Separately, FINRA took Harrington to task for not disclosing his private dealings in securities, which is required by broker-dealers. Those transactions led to an arbitration claim from one investor that resulted in National paying $105,000 to resolve, according to FINRA documents.

In addition to now being barred from the industry, Harrington was ordered to pay $105,000 to reimburse National for the claim and to pay $190,974 in disgorgement (ill-gotten gains) to FINRA.

Before all this, Harrington already had resigned from another brokerage in 2011 after the firm discovered he had failed to disclose a personal bankruptcy, FINRA documents show. Regulators took action over that omission by suspending him from working with any brokerage for 30 days in 2012.

And, after National fired him in November 2016, he then was hired by Aurora Capital in Bridgehampton, New York, until last year.

“As a firm, where we think it’s appropriate, we believe in second chances, and in most cases that philosophy works for all sides,” Jeff Margolis, Aurora Capital president, wrote in an e-mail to CNBC. He said Harrington was put under enhanced supervision and clients were contacted to assess their satisfaction.

“Eventually it became clear that although we had no major issues with him during his tenure with us, the issues raised by the regulators prior to his joining this firm were going to be insurmountable and he and we mutually agreed that he would leave the firm,” Margolis said, adding that Harrington resigned voluntarily.

Harrington, for his part, told CNBC that he disagrees with FINRA’s findings, adding that he defended himself in the FINRA case instead of hiring an attorney due to the potential high cost.

“They couldn’t be more wrong,” Harrington said. “But once they spend all sorts of resources on finding out all about you, they’re going to find something — at least something in their minds.”

Nevertheless, he’s moved on from the industry and is now running a youth sports academy, he said.

A suspension

In a separate case on FINRA’s monthly rundown, another broker was sanctioned for not disclosing to his firm a series of private securities transactions that resulted in two clients losing most of the invested money.

Without admitting or denying guilt, Seth Andrew Nannini of Charlotte, North Carolina, consented to the sanctions, which include a four-month suspension from serving as a broker and $7,500 in restitution to a client.

FINRA documents allege that between 2011 and 2012, Nannini solicited two clients of his firm — Capital Investment Group in Raleigh — to invest a total of $290,000 in a biotech manufacturer. The findings state that he moved one of the customers’ funds to an IRA held elsewhere, which made it more difficult for the firm to know about the investment.

He also allegedly invested $1,500 of his own money in the venture without disclosing it, which also violates FINRA rules.

The biotech company went bankrupt before it could repay investors. One of Nannini’s customers received just $788 of the initial $70,000 he invested as part of the company’s bankruptcy proceedings, FINRA documents state. The other customer was able to get $72,500 after filing an arbitration claim and settling with the firm, Nannini and two other parties, the records show.

Andy Penry, an attorney with the Raleigh law firm of Penry Riemann who represented Nannini in the FINRA proceedings, said of the agreement reached, “I think both my client and FINRA are satisfied with the result.”

Penry also said that Nannini’s intent is to remain in the industry if he’s able, once his suspension lifts in May.

Nannini is still listed on FINRA’s BrokerCheck as employed by Capital Investment Group.

CNBC made inquiries to the company’s media relations representative about Nannini’s future employment. There was no response.

Contact Us Today | Free Consultations | 585-310-5140

We have represented thousands of victims of investment fraud, against financial institutions that failed to discharge their duties and protect the investing public. Each case is different and our past successes are not indicative of future results; we will be glad to review your case and advise you as to your options, at no charge.

If you believe you lost money because of investment fraud or broker misconduct, it is important to take action. Contact Peiffer Wolf Carr & Kane for a FREE Consultation by calling 585-310-5140 or by filling out an online Contact Form on this website. We can hear about your situation and explore your legal options.